DEPOSIT PRODUCTS

Deposit Products and Operations

Deposit account in Islamic Banking operates based on various Shariah contracts. In contrast to the predetermined rate interest payment under conventional bank, Islamic banks give out profits or hibah (gift) payment to the depositors.

Deposit Products

Core deposit poducts of Islamic Bank can be divided into the following:

Shariah Contracts in Deposit Products

There are five deposits product that we have just seen. Here are the Shariah contracts in structuring each type of deposit.

DEPOSIT PRODUCTS IN ISLAMIC BANKING: DEPOSIT ACCOUNTS

Current Account Operations

Basic Features of Current Account - i

Current account can be opened under personal, company, organization/institution or cooperative. A personal current account can be opened on individual basis or joint account. However, an ATM card can only be issued to a personal current account under individual where customers can withdraw their money through any ATM machines.

To open an account under current account, the bank will determine an initial amount of deposit such as $1000,- or any other amounts. A cheque book will be given to the customer to make payments of for withdrawal purposes. Monthly Current account statement will be sent to customer stating the record of transactions and balance available in the account.

Current account customers may also have access to other banking facilities and services offered by the bank such as collection of the cheques, trade bills, standing instruction, auto debit, transfer of fund and operations of Cash Line (Islamic Overdraft) facility.

Other rule and regulations for current account - i

Capacity to contract

Introducer or referee

Undischarged bankrupt

Mandate given to someone else to operate the account on behalf of account holder due to reasons accepted by the bank

For company or society/institution, the bank require mandate from Board or Directors resolution or minute of committee meeting authorizing their personal in opening and operating the account as authorize signatories

Dishonoring of cheques for valid reasons such as insufficient fund, irregular signature, post dated and other technical error

Unclaimed money Act 1965 whereby balances from dormant accounts can be transfered to Unclaimed Monies

Closing of Account can be allowed on request by customer or on discretion of the bank after giving due notice. Stop Payment on Cheque by customer is allowable for valid reasons with early notification to the bank. A service charge maybe levied for every request for stop payment. Stopping of Account due to the following circumtances: Death, Bankrupcy, Lunacy, Winding up of the company, Garnishee order

Current Account - i

How does a current account - i differ from bank to bank? Lets find out

Saving Account Operation

Savings account is simply defined as an account for customers to deposit their money for safe - keeping purpose and can be withdrawn at anytime.

An Islamic saving account or saving account - i is simply the Shariah saving compliant saving account. The major different between the two is the existence of interest payment in conventional banking while Islamic banking distribute hibah payment to its depositors.

Some of features of saving account - i:

Basic features of saving account - i

You can only open a saving account for personal or private use, societies, associations and clubs but not for finance creditors and business entreprises, and only one account may be opened for any one party. Upon opening your saving account, you will need a minimum initial deposit such as $1.00 or $10.00, which the bank will determine. When you open saving account, you will be provided with passbook wherein deposit and withdrwan are recorded.

Bear in mind that there are some rules and regulations for saving account - i :

Capacity to contract - for individual must be Aqil and Baligh - defined as a person who has a sound mind and has attained the age of 12.

Identification - the customer is to come to the bank personally with NRIC or birth certificate for child under entrust account.

For societies, associations and club, certificate of registration and minute of meeting are required, authorizing their personals in opening and operating the account as authorize signatories.

The person must be undischarged bankrupt.

Unclaimed Monies Act 1965 whereby balances from dormant accounts can be transferred to Unclaimed Monies.

Closing of Account - can be allowed on request by customer or on discretion of the bank after given due notice. Stopping / freezing the account - will be done due to the following: Death, Bankruptcy, Lunacy, Garnishee order

Payment of hibah under Whadhiah Yad Dhamanah or Qardul Hasan principles (if any) solely under the bank discretion.

Hibah may be given to customer on current account and saving account which operates based on Whadiah Yad Dhamanah principles.

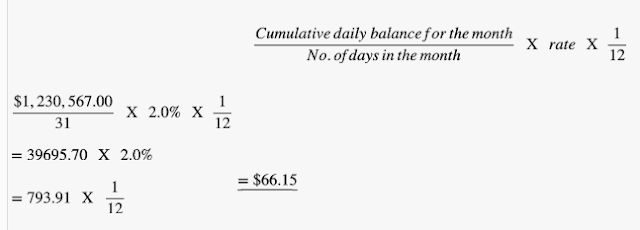

Calculation of hibah is on monthly basis based on the following formula:

For Example:

Current Account of Tangible Manufacturing Plc. with Mukhlisin Bank Limited (MBL) for the month of August:

Cummulative daily balance: $1,230,567.00

No of day in August: 31 days

Hibah rate declared by MBL: 2% p.a

The different between Current Account and Saving Account:

Current Account - is a deposit account that allows you to make payments in the form of cheques which is a major factor that helps distinguish between saving bank account and current account.

Savings Account - like current account, you will be able to withdraw cash whenever you need it using ATM, debit or charge card but with the absence of a cheque book, and to keep track the account transactions, you can review them via passbook or online bank account statement.

Term Deposit Account Operations

Term Deposit / Commodity Murabahah Deposit (CMD) account is a Shariah compliant fixed term investment involving the purchase and sale of Shariah approved commodities.

Basic features of term deposit account

Basic features of term deposit account

Under this product, the customer will buy a certain amount of commodity from a commodity broker and sell the same commodity to the Islamic bank. The purchase price of the commodity is settled immediately while the sale price is paid on differed and will incorporate an element of profit for the customer.

Investment in this product is for a fixed period and can not be terminated or sold before maturity. By locking the Murabahah price, the total profit can be known upfront. The CMD is based on the contract of Murabahah with a promise to repurchase. By doing so, CMD guarantees capital preservation and fixed return.

The application of Commodity Murabahah in deposit taking is mainly used in term Deposits. In the case of Malaysia, many Islamic bank are now offering this deposit type as a substitute for the Investment Accounts using the Mudarabah contracts. This is a result of changes in the laws affecting the Islamic banks namely Islamic Financial Services Act 2013.

Other rules and regulations for term deposits account

A term deposit account is open for:

Individual aged 18 years and above

Join account holder (Maximum 4 persons)

Business entreprises, Associations/Clubs/Societies/Organizations, Trustees, Foreigners, Professional, Goverment and Corporate Funds

The tenure of this account can be 1 - 60 months and profit are paid on either monthly or half yearly or upon maturity. The benefit of this account than of saving account is it provides higher profit rate compared to normal Saving Account.

DEPOSIT PRODUCT IN ISLAMIC BANKING : INVESTMENT ACCOUNTS

Investment Account

Investment Account Deposit can be opened by Individuals, Goverment Departments, companies and other legal entities. Deposit investment must have a specific period such as 1 month, 2 months, 3 months ...and so up to 60 months.

Investment Account Holder (IAH) refers to a customer with an investment account maintained at an Islamic Financial Institutions (IFI). Investment account holders (IAH) are customers seeking investment opportunities but at a short term period. They are looking to grow the money they deposited with Shariah compliant investment.

Basic features of general investment account - I (GIA)

They are two types of investment account:

Restricted investment account (RIA) - refers to a type of investment account where the IAH provide a specific investment mandate to the IFI, such as purpose, asset class, economic sector and the period for investment.

Unrestricted investment account (URIA) - refers to a type of investment account where the IAH provides the IFI the mandate to make the ultimate investment decision without specifying any particular restrictions or conditions.

Investment account can be opened under the principle of Mudarabah or Wakalah. For the Mudarabah Investment Account, the bank act as mudharib/entrepreneur or the fund manager and the customers act as rabbul mal (the owner of fund)

Activity:

How Mudarabah works for investment account in Islamic Bank:

The customer and Islamic bank enter into Mudarabah contract where the customer places an investment of USD $1000 (for instance) in mudarabah investment account

In this case, the customer is rabbul mal or financier and the islamic bank plays its role as mudarib or fund manager

The customer and Islamic bank mutually agree on profit sharing ratio at the time of contract is concluded

The Islamic bank as fund manager invest this money in Shariah compliant business or investment avenues

If this investment generates profit, it will be distributed among the parties according the predetermined profit sharing ratio. However, if loss occurs, the customer shall bear the loss as he is the financier in this case. The Islamic bank will not be held responsible unless the loss occurs due to negligence or misconduct of Islamic bank.

Other rules and regulations for Investment Account - i

Capacity to contract - for individual must be Aqil and Baligh - defined as a person who has a sound mind and has attained the age of 12

The investment account can be renewed up on the maturity date bu giving instruction to the bank

Profit made from investment will be distributed between customer and the bank under Mudharabah peinciple. All profit belongs to the customer for investment account under Wakalah.

Special Investment Account

How does Special Investment Account operates and what are the difference with the previous investment account?

Special Investment Account is similar to Investment Account (IA) and can be opened under the contract of Mudarabah and Wakalah. However, SIA is different to investment account where the area of investment is specific to certain investment instrument or project. Profit Sharing Ratio is normally subject to negotiation between bank and customer for account under Mudarabah principle.

We should be able to differentiate between Restricted Investment Account (normally refer to as Special Investment Account) and Unrestricted Investment Account (usually refer to as General or Term Investment Account ) in Islamic banking which applied the Mudarabah contract.

Example application of Unrestricted Investment Account (URIA) in two Islamic Bank:

Bank Muamalat Indonesia:

http://www.bankmuamalat.co.id/en/deposito-corporate/ib-hijrah-mudaraba-deposits

Bank Islam Malaysia:

http://www.bankislam.com.my/home/assets/uploads/2.-Appx-1-PRODUCT-DISCLOSURE-SHEET_INDIVIDUAL_ENGLISH-VERSION-240918.pdf

Roleplay

Mr. Azwan, The Managing Director of Mantau Pvt Ltd (MPL) has been banking with ABCD Bank Ltd. a Conventional Bank in your city. The company is enjoying both conventional credit facilities as well as deposits account in variuos forms including the management of the staff salary accounts.

MPL now wishes to convert all the banking facilities into Islamic banking. ABCD bank has an Islamic bank subsidiary, ABCD Shariah bank (ASB).

For the credit facilities, the bank Corporate Banking Division has looked into the request to convert or refinance the conventional facilities into islamic finance facilities. You as Account Relationship Officer of ASB has been assigned to look into MPL various conventional deposit accounts and to convert them into Islamic Deposit / Investment Account.

The criteria given by MPL of the needs are as follows:

Companys Current Account: safe and readily available with transaction convenience

Companys Current Account: safe and readily available with transaction convenience but with sharing of profits based on a pre - determined ratio

Staff Salary Account: safe and readily available with transaction convenience and gift at the bank discretion

Term Deposits: Safe deposit for short term and medium term with pre - determined return agreed by both parties

Special Investment Account: Investment with risk taking, for medium and long term with sharing of profits on a pre - determined ratio for specified investment project/portfolio

Task

The criteria given by MPL of the needs are as follows:

Companys Current Account: safe and readily available with transaction convenience

Companys Current Account: safe and readily available with transaction convenience but with sharing of profits based on a pre - determined ratio

Staff Salary Account: safe and readily available with transaction convenience and gift at the bank discretion

Term Deposits: Safe deposit for short term and medium term with pre - determined return agreed by both parties

Special Investment Account: Investment with risk taking, for medium and long term with sharing of profits on a pre - determined ratio for specified investment project/portfolio

Task

You are to recommend to Mr. Azwan the most appropriate deposits / investment types to meet the above criteria by mentioning shariah contract/principles applied, the Arabic terms used for the return and the features of each. You should also highlight on the most probale uses of each of the above funds by the bank to earn the profits which will later be distributed in accordance to the Shariah contract / principles applied.

Companys Current Account: safe and readily available with transaction convenience - Current Account - i. Current Account is deposit account that allows you to make payments in the form of cheques.

Companys Current Account: safe and readily available with transaction convenience but with sharing of profits based on a pre - determined ratio - Current Account - i. Current Account is deposit account that allows you to make payments in the form of cheques. Hibah may given for current account operates under Wadhiah Yad Dhamanah principle or Mudharabah. For example product Giro iB from CIMB Syariah, details products link: https://www.cimbniaga.com/syariah/en/personal/products/funding/giro/giro-ib.html

Staff Salary Account: safe and readily available with transaction convenience and gift at the bank discretion - Saving Account - i. You will be able to withdraw cash whenever you need it using ATM, debit or charge card but with the absence of cheque book, and to keep track the account transactions you can review them via passbook or online bank account statement. Hibah may given for saving account operates under Whadhiah Yad Dhamanah principle. For example product iB Payroll Saving from CIMB Syariah, details products link: https://www.cimbniaga.com/syariah/en/personal/products/funding/savings/tabungan-reguler/tabungan-ib-payroll.html

Term Deposits: Safe deposit for short term and medium term with pre - determined return agreed by both parties - Commodity Murabahah Deposit (CMD). CMD is shariah compliant fixed term investment involving the purchase and sale the shariah approved commodities. The CMD under the Islamic contract Murabahah with the promised to repurchase. For example, Term Deposit - i (Tawarruq) from Bank Islam Malaysia, detail link: http://www.bankislam.com.my/home/personal-banking/deposit-products/term-deposit-i-tawarruq/

Special Investment Account: Investment with risk taking, for medium and long term with sharing of profits on a pre - determined ratio for specified investment project/portfolio - Special Investment Account can be opened under the contract of Mudarabah and Wakalah. For example Deposit iB, Investment saving from CIMB Niaga Syariah, details product link: https://www.cimbniaga.com/syariah/en/personal/products/funding/deposito/deposito-ib.html

Companys Current Account: safe and readily available with transaction convenience but with sharing of profits based on a pre - determined ratio - Current Account - i. Current Account is deposit account that allows you to make payments in the form of cheques. Hibah may given for current account operates under Wadhiah Yad Dhamanah principle or Mudharabah. For example product Giro iB from CIMB Syariah, details products link: https://www.cimbniaga.com/syariah/en/personal/products/funding/giro/giro-ib.html

Staff Salary Account: safe and readily available with transaction convenience and gift at the bank discretion - Saving Account - i. You will be able to withdraw cash whenever you need it using ATM, debit or charge card but with the absence of cheque book, and to keep track the account transactions you can review them via passbook or online bank account statement. Hibah may given for saving account operates under Whadhiah Yad Dhamanah principle. For example product iB Payroll Saving from CIMB Syariah, details products link: https://www.cimbniaga.com/syariah/en/personal/products/funding/savings/tabungan-reguler/tabungan-ib-payroll.html

Term Deposits: Safe deposit for short term and medium term with pre - determined return agreed by both parties - Commodity Murabahah Deposit (CMD). CMD is shariah compliant fixed term investment involving the purchase and sale the shariah approved commodities. The CMD under the Islamic contract Murabahah with the promised to repurchase. For example, Term Deposit - i (Tawarruq) from Bank Islam Malaysia, detail link: http://www.bankislam.com.my/home/personal-banking/deposit-products/term-deposit-i-tawarruq/

Special Investment Account: Investment with risk taking, for medium and long term with sharing of profits on a pre - determined ratio for specified investment project/portfolio - Special Investment Account can be opened under the contract of Mudarabah and Wakalah. For example Deposit iB, Investment saving from CIMB Niaga Syariah, details product link: https://www.cimbniaga.com/syariah/en/personal/products/funding/deposito/deposito-ib.html

Readmore:

https://www.openlearning.com/inceif/courses/intro-to-islamic-banking/investment_account

https://blossomfinance.com/press/17-applications-of-mudarabah-in-islamic-financial-institutions0

No comments:

Post a Comment